Gifts that provide income

You may want to make a substantial gift to Regis College in the form of appreciated securities or cash, but perhaps you are hesitant to give up the steady dividend income that you are receiving. If so, you may want to consider our life income plans. Investing in a life income gift often provides a significant increase in annual income when compared to the income earned in a savings account or from current dividends. By planning the form and timing of gifts, you may find that you can make a gift while retaining personal security.

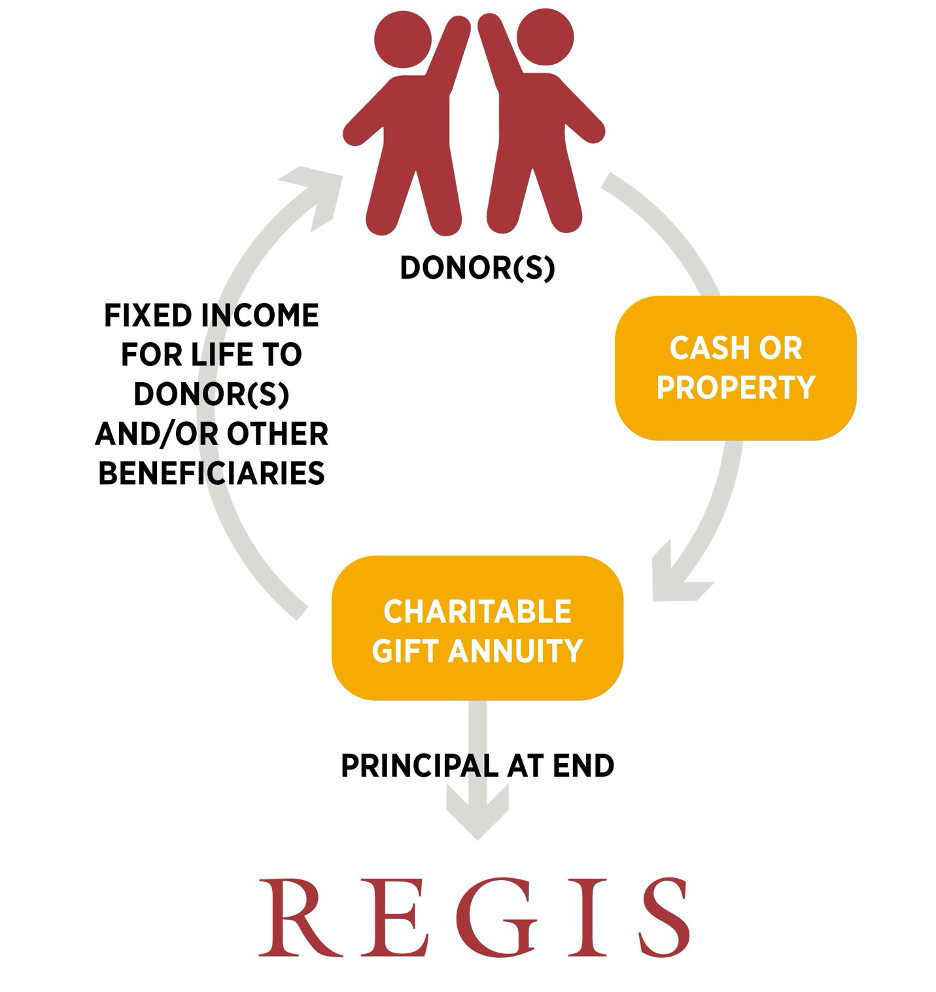

Charitable Gift Annuities

A charitable gift annuity is a simple agreement that allows you to make a gift to Regis College while receiving income and tax benefits. In exchange for an outright gift, Regis pays a fixed dollar amount each year to you and/or another beneficiary for life. The amount of the annual payments is determined based on the age(s) of the income recipient(s) and IRS discount rate at the time the gift is made.

- Deferred Gift Annuity: If you are younger than 60 or don’t need your payments immediately, you can set up a deferred gift annuity. This allows you make your gift and receive a tax deduction, but delay receiving annuity payments until a later date of your choice, such as when you reach retirement.

As a gift annuity donor, you will receive:

- A guaranteed income stream for life

- Partial tax-free income

- A significant charitable deduction

- A reduction in capital gains tax, if applicable

To receive a sample projection of how a charitable gift annuity may be beneficial to you, please call 781-768-7220.

How it Works

EXAMPLE: Mary, age 85, sets up a $100,000 charitable gift annuity with Regis. The current rate based on her age is 8.0%*, which means Mary’s gift will provide her with annual payments of $8,000. Mary will get a significant federal income tax charitable deduction in the year of the gift.

*Sample rate subject to change.

Charitable Trusts

A charitable remainder trust provides you or other named individuals income each year for life (or a period not exceeding 20 years) from assets in the trust. There are two ways to receive payments and each has its own benefits:

- Annuity Trust: An annuity trust pays you the same amount each year, which you choose at the beginning. Your payments stay the same regardless of fluctuations in trust investments.

- Unitrust: A unitrust pays you a variable amount each year based on a fixed percentage of the fair market value of the trust assets. If the value of the trust increases, so do your payments, and vice versa.

Charitable Annuity Facts

- A CGA guarantees you an income stream for life.

- You receive partial tax-free income.

- In the year of the gift, you receive a significant charitable deduction.

- Reduce capital gains tax by funding a CGA with appreciated stock.